[ad_1]

Japan is one of the most important countries in the world. It is the third-biggest economy with a gross domestic product (GDP) of almost $5 trillion. Japan is also the biggest holder of US debt, with over $1.1 trillion in holdings.

The Bank of Japan (BoJ) is the third most influential in the world after the Federal Reserve and the European Central Bank (ECB).

As you can imagine, Japan is the driving force of the Asian session and one of the most important for picking up signals to use in the other two sessions. In this article, we will look at how to day trade in Japan.

Role of Japan in the global economy

Japan, a country with over 125 million, is unique for several reasons. First, it is a resource-scarce country that imports most products.

Despite this, Japan ranks as number 1 in terms of economic complexity. According to the OECD, Japan is the fourth-biggest exporter and importer in the world. It exports goods worth over $731 billion and imports $731 billion.

Second, Japan is also unique because of its falling population. The country’s population dropped by more than 556k in 2022. It also has one of the oldest populations in the world and analysts believe that it will drop below 100 million by 2056.

Third, Japan is one of the biggest industrial powers in the world. Its biggest exports are products are cars, integrated circuits, vehicle parts, and machinery among others. Its top imports are crude petroleum, petroleum gas, and coal among others.

One of the biggest roles of Japan in the world economy is its role in the United States, where it is the biggest lender. Japan uses its vast dollar resources to invest in US debt and equities. Data shows that Japanese companies and investors were the biggest investors in the US. The others are Germany, Canada, and the United Kingdom.

Furthermore, Japan has a big financial services industry. It has the second-biggest stock market in Asia with a combined market cap of over $5 trillion. The Shanghai exchange is the biggest stock market while the Shenzhen market is the third.

The importance of the Bank of Japan

The Bank of Japan (BoJ) is the third-most important central bank in the country. It has over $7.45 billion in assets, making it bigger than Japan’s GDP. The BoJ has been working to fix Japan’s economy after years of stagnation and deterioration.

It has done that by leaving negative interest rates for years. It has also embarked on quantitative easing, which sees it print billions of yen every month.

Bank of Japan’s decisions tend to have major impacts on financial assets like global stocks and the Japanese yen. The BoJ, like other central banks, meets eight times per year to deliver its interest rates.

Related » How Monetary Policy Works

Day trading in Japan

Japan is a top market for day traders, which explains why many companies have established a base in the country. One reason is that Japan is a democracy that is well-known for being less corrupt.

Also, Japan has a great education system that introduces students to finance earlier in their career.

Most importantly, Japan has a strict financial regulator who works to safeguard the market. The regulator comes up with rules and ensures that all brokers and exchanges operating in the country are regulated.

People in Japan can invest in Japanese companies listed in Tokyo. Some of the most notable publicly-traded Japanese companies are:

- Toyota

- Softbank

- Mitsubishi

- Sony

- Fast Retailing

- Shin-Etsu Chemical

among others.

In addition, people in Japan can invest in international assets like forex, commodities, and stocks using international brokers like Interactive Brokers, eToro, and Capital.com.

It is also possible to create a trading floor and access international assets using our DTTW platform.

Best time to day trade in Japan

Japan’s markets open at 9:00 AM and close at 3:00 PM. The morning session starts at 9:00 AM and closes at 11:30 AM. The afternoon session, on the other hand, starts at 12:30 PM and ends at 3:00 PM.

In this case, most people find it easier to trade during the morning session since it has more volume and volatility.

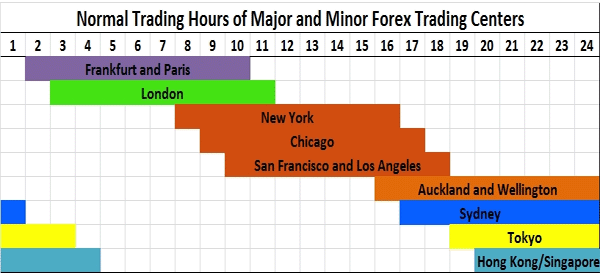

Forex traders, on the other hand, can trade every day, Monday to Friday at any time. However, historically, we see that the Japanese session has limited market action and volatility. Therefore, the best times to day trade in Japan are during the intersection of Asian and European markets.

Also, it is more rewarding to day trade during the intersection of the European and American markets. Either way, we recommend that you focus on day trading during the American and European sessions because of the volatility and volume of economic data.

Day trading the Japanese yen

The Japanese yen is a major currency that is the fourth most popular after the US dollar, euro, and the British pound. The most popular JPY pair is the USD/JPY, which is a forex major.

In addition to this forex major, the other JPY crosses to consider are the EUR/JPY, GBP/JPY, and the AUD/JPY. In most cases, these forex pairs tend to have a close correlation. Therefore, if you buy the USD/JPY, EUR/JPY, and the GBP/JPY, it means that you will likely make money if they go up and vice versa.

Most important Japan economic data

Like other currencies, there are several important economic numbers from Japan. Some of the most notable ones are:

- Inflation – This data shows the movement in product prices. Historically, Japan has some of the lowest inflation levels in the world.

- Trade – The JPY currency tends to react to exports and imports numbers. This is notable since the country is the fourth biggest exporter and importer in the world.

- Employment – Traders watch the country’s jobs numbers. However, like inflation, Japan has one of the lowest unemployment rates in the world.

- Industrial production – This is an important figure that provides information about the performance of key industries. It is an important figure since Japan is a major industrial country.

The other important catalysts for the JPY currency are the interest rate decision by the Bank of Japan, manufacturing PMIs, and retail sales.

FAQs

Is day trading illegal in Japan?

Day trading is completely legal in Japan. In fact, there are millions of day traders in the country. The financial regulator has set up important regulations to safeguard traders and investors.

How much do you need to day trade in Japan?

There is no minimum amount for day trading in Japan. Some online brokers allow as little as $50 to start. However, we recommend that you start with a minimum of $1,000.

Is it possible to day trade the TSX?

Yes, it is possible to day trade the TSX index. However, if you have access to European and American stocks, we recommend them because of more volatility.

External useful resources

- Banking on growth: Ensuring the future prosperity of Japan – Mc Kinsey

[ad_2]

Source link