[ad_1]

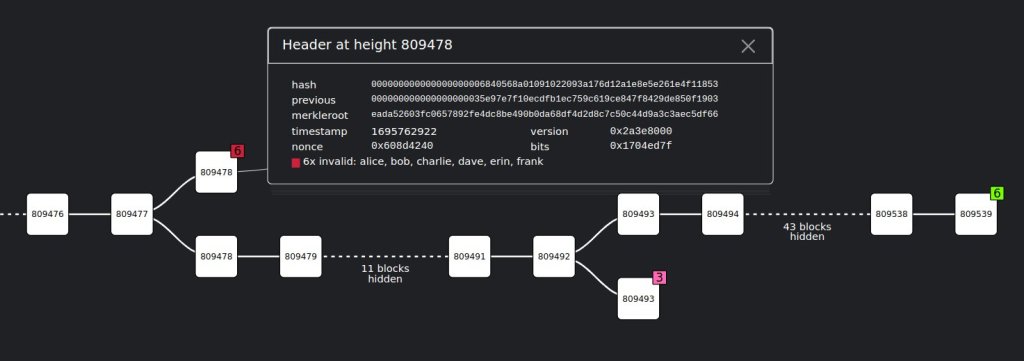

MARA Pool, the Bitcoin mining pool operated by the publicly listed Marathon Digital Holdings, had a transaction ordering issue on September 27 after it mined an invalid block at block height 809478. The invalid block was first picked by an X user, “0xB10C”, before Jameson Lopp, the CTO of Casa, a Bitcoin-focused company, later confirmed it.

Lopp scanned his node and noted that MARA Pool had spent an output before it was created, validating a double-spent transaction.

Marathon Digital Mined An Invalid Block

In Bitcoin, a mining pool or an individual miner can’t approve an “illegal” transaction originating from any network user. By double-spending, the user posting the transaction tries to cheat the system.

Bitcoin is self-auditing, and every miner and mining pool connected to the network must always confirm that all transactions in the latest block and attached to the longest chain are valid. If a block contains an invalid transaction not supported by other miners, it will be rejected. This was the case with the block verified by MARA Pool; other miners automatically dismissed it and didn’t build on it.

BitMEX Research findings show that the block was disregarded because of a transaction ordering problem. In Bitcoin, miners decide the order of transactions within a block based on the fees attached.

All these transactions are picked from the mempool, a temporary storage for all unconfirmed transactions. While they can arrange them in any order, this changes once the block is confirmed after its cryptographic puzzle is solved.

Ensuring transactions are ordered chronologically makes Bitcoin resistant to double-spending, which can destroy a public network’s credibility. Bitcoin prevents this by automatically proving that only a particular transaction was the first to be confirmed on the network, invalidating any other.

Bitcoin Remains Volatile

The event also coincided with heightened Bitcoin volatility. At September 27 highs, the coin had soared to as high as $27,263 and remains capped inside a $1,000 range, looking at price action in the daily chart.

Nonetheless, the surge was quickly met with strong rejections. The coin fell sharply from today’s highs, and an inverted hammer forms in the daily chart. Despite the pullback, Bitcoin is roughly up 5% from September lows. Buyers have the upper hand since prices are trending inside the bullish range established in the second and third weeks of the month.

Presently, prices are trending above the primary support at around $26,000. Looking at price trends in the past few weeks, the path of least resistance is southwards despite the recent revival.

Feature image from Canva, chart by TradingView

[ad_2]

Source link