[ad_1]

Volatility is an important aspect in the financial market. It refers to how much and how quickly an asset price changes over time.

A higher period of volatility means that an asset is changing quickly. For example, if a stock opens at $10 and rises to $13, and falls back to $9 in a single session (within minutes, for a scalper), it can be said to be highly volatile.

An asset’s volatility differs from other concepts in the market. For example, it differs from a ranging market, where an asset remains in a narrow range in an extended period. The other difference is when an asset is moving in an uptrend or downtrend.

In a nutshell, volatility is one of the crucial factors for those who practice trading, focusing on short-term trades. Therefore, in this article we are going to analyze volatility in depth and see what are the best techniques to use it to our advantage (and avoid huge losses)

What is volatility and what does it mean in stocks?

Volatility refers to a situation where the price of a stock rises and falls within a few minutes or days. This period can be highly profitable for day traders, who are not concerned about the long-term future of the company.

However, it can also lead to significant losses, especially when traders are not prepared or equipped to deal with it.

A good example of volatility in stocks is what happened with GameStop (GME) on January 2021.

For starters, GME is a large company in a traditional industry. It sells video games in stores at a time when many people are shifting to digital games. As such, many people strongly believed that the company would file for bankruptcy like other traditional retailers.

Therefore, many investors placed large short bets against the company. In 2021, many social media users started to hype the stock. Within a few days, the stock climbed from $17 to $483.

Related » Short Squeeze and How to Avoid it

It then dropped to $38 and rose back up to $182. This is a perfect example of volatility in the stock market.

What does volatility mean?

In the above section, we have looked at what volatility is and what it means. So, what are the implications of volatility for day traders and investors?

High volatility is usually a sign that several things are happening in an asset. For example, it means that the stock is making headlines that are leading to more demand and supply.

Most day traders prefer trading stocks that are highly volatile because of the potential swings that happen.

On the other hand, low volatility is a sign that the asset is either not seeing a lot of demand or that it is not making headlines. Day traders don’t like trading in low-volatile markets.

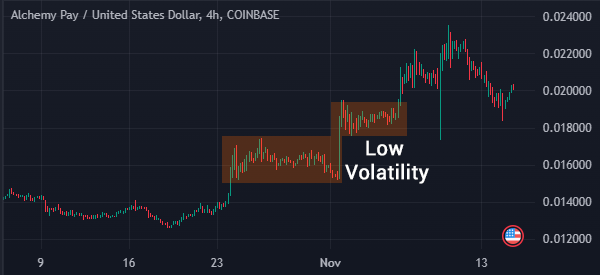

For example, in the chart below, we see that Alchemy Pay had low volatility for a while before it made a bullish breakout. This made it a difficult price to trade the token.

Types of volatility

There are three primary types of volatility: historical, implied, and realized.

Historical volatility

As the name suggests, historical volatility is defined as the measure of how an asset has been volatile in a certain period.

For example, some financial assets are known to be highly volatile over time. As a result, an asset that has a high historical volatility will often have future volatility.

Historical volatility is calculated using the following formula:

| Historical volatility = √[(∑(Ri – Ravg)²)/(n – 1)] |

In this case, Ri is the return for the period i while Ravg is the average return over a certain period. n is the number of periods.

Implied volatility

Implied volatility, on the other hand, is an important type of volatility that is common in the options market. It is a measure of the market’s expectation of future volatility. The most common approach for measuring this volatility is known as the Black-Scholes model.

Unlike historical volatility, this one is a forward-looking one, meaning that it can help you predict the future price of an asset. Some of the factors that can affect this volatility are time to expiration, strike price, interest rates, and other news and events.

Realized volatility

Realized volatility is another type of volatility. It is a measure of actual volatility over a given period of time.

This volatility is calculated by summing the squared returns of an asset over time and then dividing by the number of periods minus one. This formula is calculated using the following formula:

| Realized volatility = √[(∑(Ri – Ravg)²)/(n – 1)] |

In this case, the Ri is the return for period i; Ravg is the average return over the given time period while n is the number of periods.

Causes of stock volatility

A common question among many traders is on what exactly causes volatility in the stock market.

Social Media

First, as described above, there is the role of social media platforms like Stocktwits, Twitter, and Reddit. These platforms have become highly influential since almost 30% of all daily volume in the US is from retail traders.

Therefore, as a trader, we recommend that you have a feed of what is happening in these platforms.

There are a few reasons why social media is a big cause of volatility in the market. First, many experts and analysts tend to deliver their statements on social media platforms like Twitter.

Second, some corporate officials make statements on social media. For example, Elon Musk, who owns Tesla, Twitter, and SpaceX, often moves the company’s shares by his statements.

Third, in some cases, social media users can break news and even pump stocks and other assets. This happened well during the meme stock frenzy of 2021. At the time, stocks used to either rally or plunge because of the actions of social media users.

Economic data

The other major cause of volatility in the stock market is economic data. These numbers are usually important because of their implications to monetary and fiscal policy.

Some of the most important economic numbers to watch are:

- Inflation

- Employment

- Manufacturing

- Services PMIs

- Industrial production

- GDP.

In most cases, strong jobs and high inflation data sends a sign that the Federal Reserve will hike interest rates. As a result, stocks tend to drop when the Fed publishes these numbers.

Similarly, if the numbers are quite bad, as we saw at the onset of the Covid-19 pandemic, they send a sign that the Fed will cut rates, boosting stocks.

Market sentiment

The other cause of market volatility is known as market sentiment. There are two main types of sentiment in the market: risk-on and risk-off.

A risk-on sentiment is a situation where investors are willing to embrace risks while a risk-off sentiment is when they are afraid of risk.

This sentiment is caused by the overall market situation. For example, when stocks are rising, it usually leads to a risk-on sentiment or greed. When they are falling, investors tend to be fearful, which pushes them much lower.

Macro Environments

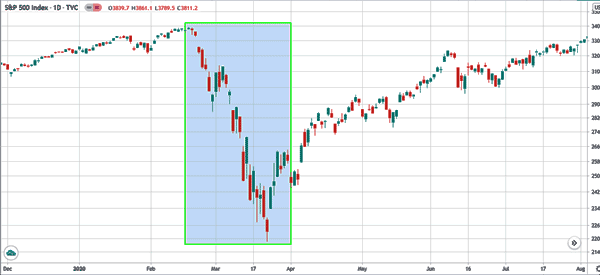

Even the overall macro environment tends to lead to volatility. For example, in March 2020, the coronavirus pandemic led to significant uncertainties. As a result, many investors rushed to sell their holdings while some traders bought the dips.

As a result, many share prices dropped sharply in the first quarter and parts of Q2. The chart below shows the performance of the S&P 500 index during that period.

There are other macro issues that lead to this kind of volatility. For example, during the Trump administration, the trade war led to volatility in some stocks. Also, wars and natural disasters like the Japanese earthquake led to intense activity in the market.

Related » Best Financial Assets to Trade during Exceptional Events

Earnings

Third, stocks tend to be volatile slightly before and after they release their quarterly earnings. Before earnings, some traders are trying to forecast how the firm will perform. And after earnings, the volatility happens as traders digest the number.

Earnings are important because they show how the company did in the previous quarter. They also give guidance of what to expect in the near term.

In most periods, stocks tend to either gap up or gap down after earnings. For example, in the chart below, we see that the PLUG stock dropped sharply after earnings.

There are several things that move stocks after earnings. These things include the company’s revenue growth, whether it beat or missed estimates, and whether it provided good guidance.

In most cases, a company that publishes strong growth but downgrades its guidance will often drop.

Other causes

Other causes of volatility in stocks are analyst calls, mergers and acquisitions, and company-specific news like management changes and product launches.

Most importantly, activities in the bond market usually have impacts on the stock market. For example, when the yield curve inverts, investors tend to rush out of the market as they anticipate a recession.

Similarly, when bond yields rise, some investors usually exit high-volatile stocks for safe-havens.

A common challenge among traders is on how to identify volatility in the market.

CBOE Vix Index

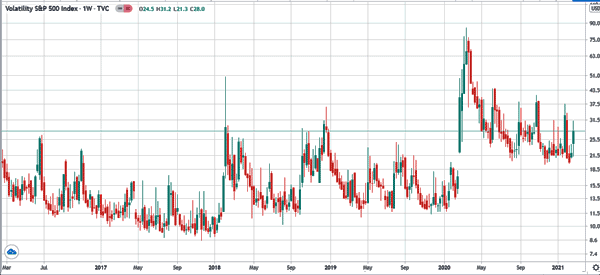

One of the best and most common tools used to measure this volatility is the CBOE VIX index. This is an index that looks at the performance of stocks in the S&P 500. When it rises, it is usually a sign that volatility will rise.

The chart below shows that the VIX has been elevated in the past five years. This is mostly because of Trump’s trade wars and the Covid-19 pandemic.

Fear and Greed Index

Another tool that can show you about volatility is the fear and greed index. Developed by CNN Money, this tool is made up of several sub-indices that gauge the sentiment in the market. The popular sub-indexes that comprise the index are stock price breadth, VIX, stock price strength, and junk bond demand among others.

A significantly low reading of the fear and greed index is a sign of fluctuations in the market.

Calendars

The other important tool that will help you in this is the calendar. These are tools that provide a schedule of events that could lead to volatility. Examples of calendars are earnings, economic, dividend, splits, and expiration calendars.

The economic calendar shows a list of economic events while earnings provide a list of companies that are about to publish their results. Dividend calendar shows companies that are about to pay a dividend while a splits calendar shows companies that are about to split their stocks.

Having access to these calendars will help you to prepare for this volatility.

Other technical indicators

There are other popular technical tools used to measure volatility. Among the popular indicators that can show you this are the Average True Range, Relative Volatility Index, Historic volatility, and Bollinger Bands, among others.

The chart below shows the S&P 500 with some of these indicators.

How to trade volatile stocks

With all this in mind, how do you trade volatile stocks? There are several approaches to trade highly volatile stocks.

Buying the dip or selling the rip

The first approach for trading volatile stocks is known as buying the dip or selling the rip. Buying the dip refers to a situation where a trader buys a financial asset that has made an irrational sell-off.

For example, if a stock plunged after earnings, you can buy the asset’s dip, hoping that it will bounce back.

The other approach is known as selling the rip, where you short an asset that has made a big dip. The idea is that the asset price will continue falling after it makes a big dip.

Gap and go

The other approach for trading volatile stocks is known as gap and go. As you will realize, down and up gaps happen often when assets are in a volatile phase.

A gap and go is an approach of buying an asset in the direction of the gap. If it makes a big gap, often over 4%, a trader can buy and hold the trade for a while.

Scalping

The other approach for trading volatile stocks is known as scalping. Scalping is defined as a strategy where a trader buys or shorts stock and holds them for a short period. The goal is to hold the trades for a few minutes and make a small profit several times a go.

A good example of this is where a trader focuses on making $5 per trade. If you open 100 trades per day, this means that you can make at least $500 per day.

Using technical indicators

The other trading approach is known as using technical indicators like moving averages, VWAP, and Bollinger Bands.

For example, if a stock moves above the VWAP indicator, it is a sign to buy and vice versa. The same applies to other indicators like moving averages and Bollinger Bands.

Trend following

This is an approach where you buy an asset that is trending or short one that is moving in a downtrend. The thesis is that an asset will continue rising if it is already in an uptrend. It also means that the asset will continue in a downtrend.

Traders use several approaches in trend-following. Some use technical indicators like moving averages while others use chart patterns like bullish and bearish pennant and flag patterns. Other continuation chart patterns are ascending and descending triangle patterns.

Arbitrage

The other approach for trading volatile stocks is known as arbitrage. This is an approach that involves focusing on two financial assets.

For example, you can trade energy stocks like Shell and ExxonMobil, which tends to move in the same direction. In this case, you can buy one stock and short the other one.

How to spot volatile stocks

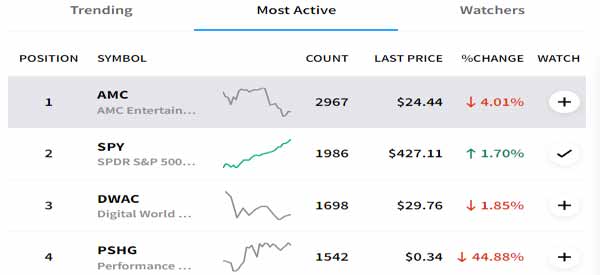

So, how do you identify volatile stocks in the market? There are a few approaches to go about this. First, you can use social media platforms like Reddit, Twitter (X), and StockTwits. In most cases, you will find that the most volatile stocks are the ones that trend in these platforms. For example, the chart below shows the most active stocks and crypto in StockTwits.

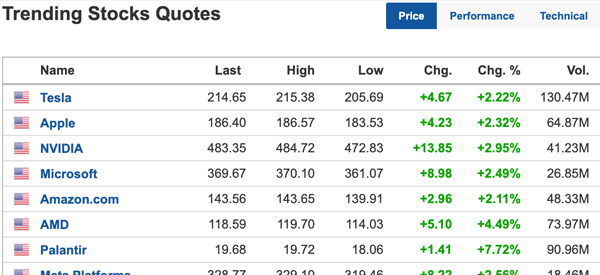

Second, the other approach is to use websites that track the top moving stocks. These websites have a feature known as the trending stocks and top movers. The chart below shows some of the most trending stocks in Investing.com.

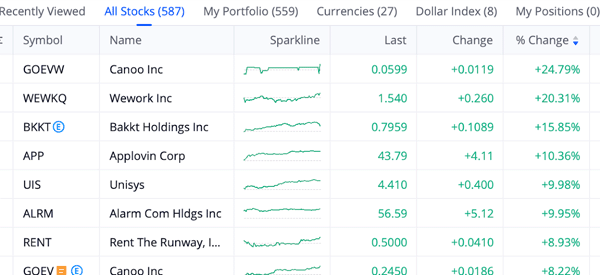

Further, you should use a watchlist which is a document that looks at the top-moving stocks in the market. At DTTW, we send our subscribers a free watchlist with some stock picks and the reason for their movement. The chart below shows an example of some of the top moving companies.

Volatility in different market hours

The American stock market is divided into several periods. It starts with the pre-market period, which begins at around 4 am. It then moves to the regular session, which starts at 9 and runs to 4pm. The final session is the extended hours.

These sessions have several levels of volatility. The pre-market and extended hours tend to be highly volatile since companies make major news during this period. For example, companies usually publish their earnings during the extended or pre-market periods.

The other highly volatile period is when the market opens. This volatility happens as the orders placed in the pre-market are executed. These orders are usually pending orders.

After the initial volatility, stocks tend to retreat as the regular session continues. It then increases towards the close as people start exiting their trades for the day.

How to protect from periods of volatility

Volatility is a good thing for day traders. However, all traders need to protect themselves from the negative impacts of high volatile markets. Here are some of the top strategies to protect yourself from this volatility.

- Not leaving trades open overnight – Stocks tend to either fall or rise sharply in volatile markets. Therefore, it is important to close all your trades before the market closes since you are not sure how it will open the following day.

- Stop-loss and take-profits – A stop-loss stops your trade automatically when it hits a certain loss level while a take-profit stops it when it hits your profit target.

- Use pending orders – Instead of opening a market order, we recommend you use pending orders. These orders include buy-stop, sell-stop, buy limit, and sell-limit.

- Use a trailing stop – A trailing stop is a tool that stops your trade when it reaches a certain point. Unlike a standard stop, it moves with the price. As such, in case of a reversal, it captures the initial profits.

FAQs

Is volatility good for day trading?

Yes. Most day traders prefer trading in highly volatile markets because of the several market opportunities that come up. They also love trading in trending markets. The worst period is when the market is in a tight range.

Is it good to day trade highly volatile stocks?

Yes. These stocks are good for day trading. However, since volatility is a double-edged sword, you need to protect yourself from this volatility using the tools mentioned above.

Final thoughts

Volatility is an important thing in the market. Indeed, a few years ago, many hedge funds blamed the lack of volatility for their underperformance. However, it can also lead to substantial losses in your day trading process.

Therefore, we recommend that you use the best risk management strategies to reduce risks.

External useful Resources

- Volatility From the Investor’s Point of View – Investopedia

[ad_2]

Source link