[ad_1]

Bitcoin higher as market ‘turns corner’ from Binance issues. CZ is the latest exchange founder to fall. SEI and Blur enter the top 100 coins.

BNB

Binance Coin (BNB) lost 8% last week after news of a settlement with the U.S. Department of Justice. The deal will see the exchange pay a fine of $4.3 billion while its founder and CEO Changpeng Zhao will step down and face a jail sentence.

Also known as CZ, Zhao is the latest exchange founder to fall, just a few weeks after Sam Bankman-Fried was convicted for the fall of the FTX exchange.

The settlement relates to a long-running money laundering case with the world’s largest exchange accused of turning a blind eye to money from groups related to terrorism and hacking. Binance is expected to pay the large fee, while its CEO is negotiating his freedom.

However, the crypto market cheered the news and saw it as a chance to build something stronger.

Brian Armstrong, CEO of rival Coinbase, said:

The enforcement action against Binance, that’s allowing us to kind of turn the page on that and hopefully close that chapter of history. I think that regulatory clarity is going to help bring in more investment, especially from institutions.

“It’s true that there have been some small amount of illicit activity in crypto but it’s actually less than 1% from what we’ve seen. If you look at illicit uses of cash it’s oftentimes more than that,” Armstrong added.

Coinbase has also had recent regulatory struggles and is in a battle with the U.S. Securities and Exchange Commission over allegations that the company violates securities laws with its platform.

“We see the prospect of settlement as positive as uncertainty around Binance itself would subside and its trading and BNB Smart Chain business would benefit,” JPMorgan analyst Nikolaos Panigirtzoglou also said.

“For crypto investors, the prospect of settlement would see the elimination of a potential systemic risk emanating from a hypothetical Binance collapse”.

Binance Coin was trading at $227 on Monday and traders should keep an eye on the $200 level. There is currently support around the $203.50 level also. The company had a chance to learn from the mistakes of FTX on collateral issues but it was the collapse in value of the FTT token that took down FTX.

BTC

Bitcoin was off less than 1% for the week and was holding the $36,000 level despite the news of the Binance settlement.

Bitcoin starts the latest week around the $36,000 price level and will look for a push to $40k but risk sentiment was lower on Monday with stocks falling early.

The world’s largest crypto reached a new milestone last week as nearly 84% of its total circulating supply is currently in profit, something that has not been seen since November 2021. The recent price rally saw more than 16.36 million BTC or 83.6% of the circulating supply in profit, a level last seen in November 2021 when the crypto market had just retreated from its all-time high (ATH), according to data from Glassnode.

“With market trading reaching year-to-date highs, more than 83.6% of Bitcoin supply is currently in the black, the highest level since November 2021 (near all-time highs),” Glassnode said.

However, they added that “the size of unrealized profits held in these coins remains modest and has so far not been enough to incentivize long-term holders to lock in profits.”

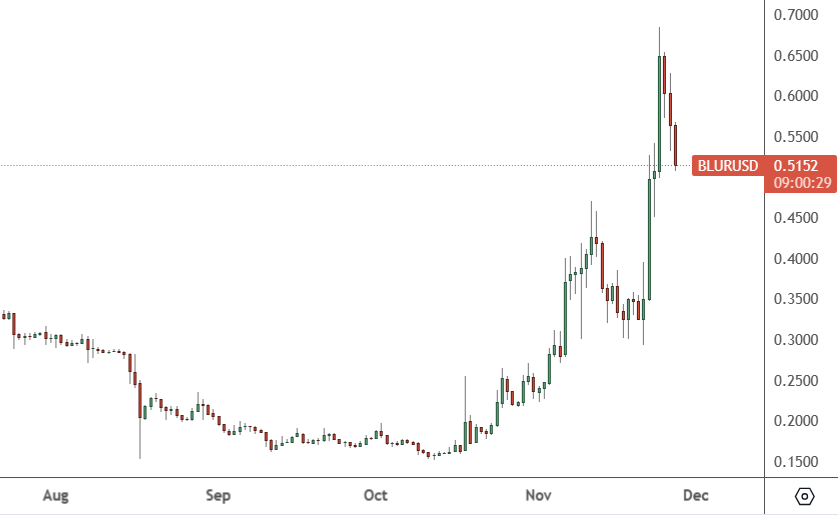

BLUR

Blur was up over 55% for the week and reached number 79 in the list of coins by market value.

BLUR is the governance token of a non-fungible token (NFT) marketplace and aggregator platform that offers features such as real-time price feeds, portfolio management, and NFT comparisons. The project says it has a faster and more intuitive platform than rival marketplaces.

The platform is hosted in Ethereum and became more mainstream when it promised an airdrop to the top platform users who tested the site on beta ahead of the October 2022 launch.

BLUR now has a market cap of $584 million with a price of $0.5200. The coin could continue to gain in value if the platform can take NFT business away from its rivals.

OpenSea is still the largest NFT marketplace but sales have slumped from the boom to 2021. The dominant chain for NFTs is still Ethereum but Polygon and Solana did start to gain some ground. A recent price surge in the latter’s SOL token could see further progress.

The top ten collections of the last 30 days are all ETH-based with Bored Apes, Mutant Apes, and CryptoPunks still the dominant three. Blur has jumped from around $0.150 to $0.515 and will look for buyers to mount another push higher.

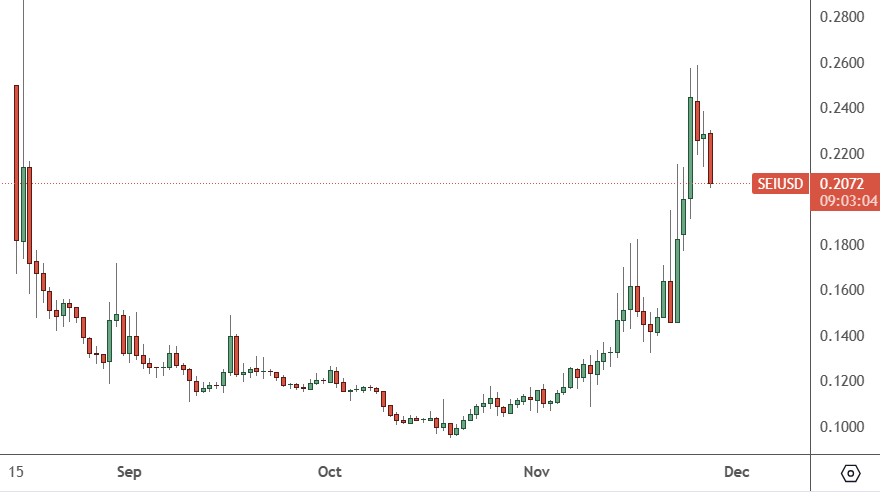

SEI

Another coin surging into the top 100 was SEI with a gain of around 34%. The project now ranks at number 97 with a market value of $503 million.

SEI is seen as a competitor to Solana and jumped on the news of an investment from stablecoin issuer Circle. The Sei Network is a layer-1 blockchain that claims to be faster than Solana. Circle said they were investing in the SEI network to expand use cases for its USDC dollar-pegged digital asset.

“SEI is designed specifically to address the primary use case of cryptocurrency – the exchange of digital assets. This blockchain isn’t just fast; it’s the fastest, achieving 390ms time to finality and boasts unparalleled speed.”

“Through integration with SEI, USDC will provide developers and entrepreneurs around the world something they’ve never had before: the ability to build products and commerce on an open platform globally, quickly, and cheaply with instantaneous transaction settlement.”

SEI boasts transaction completion of 500 milliseconds whereas Solana’s blockchain transaction finality is around 2.5 seconds. SEI also has higher transactional throughput a capability of 20,000 orders per second (ops) while Solana can handle 10,000 transactions per second (tps).

Sei’s $500 million market cap compares to $23 billion at Solana leaving room to advance.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.

[ad_2]

Source link