[ad_1]

In this second video, we continue to look at the momentum tails and how they can help us make better trading decisions or rather, how it takes less focus to make decisions you are making anyway. We take a look at using the tails in correlated markets and we also discuss the power of one of the simplest tools – the center line. It’s all about having the brain do less processing. We look at the differences between thinner and thicker markets, and how volume or the lack of, can affect momentum, which can also be affected during news or economic data release.

Notes:

Hi all,

Let’s continue to look this week at the momentum tails, and let’s start with correlations.

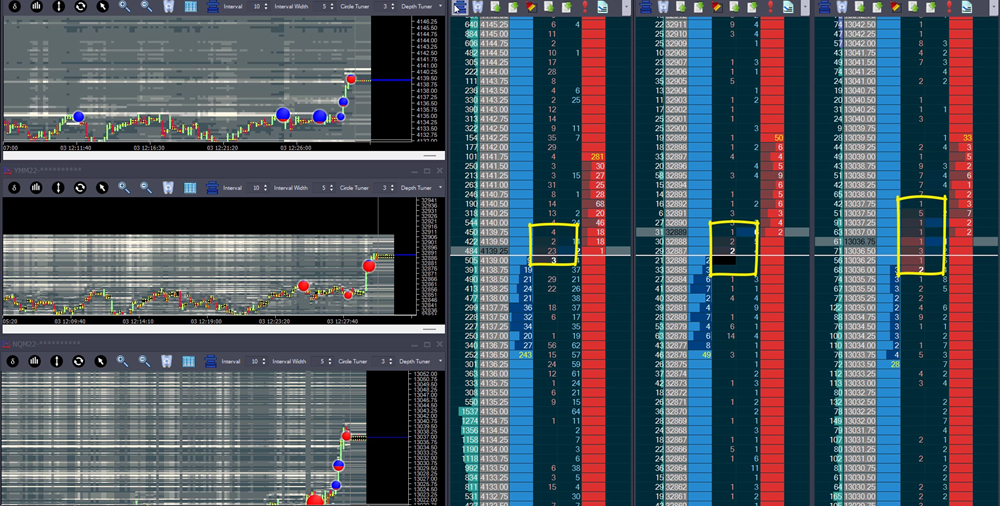

Here we have 3 correlated markets, the ES, YM, and NQ, and we are looking for a direction agreement and to help us better view that direction, we use the centerline. We’ve just recentered the depth and sales, and just pausing the video here so we can better explain what this centerline can help us with. And first, it will allow us to easily gauge what is going on in all 3 markets. How far has each market moved from that centerline, so it’s a simple reference point we can reset at any time which lets us eyeball whether the markets are moving in the same direction or not.

Now, if we are looking to take a trade in the ES and we have NQ going up and YM going down, usually ES goes sideways. And if NQ and YM are in synch, for example, both moving higher, then ES will normally be trending. Quite often, 2 markets will be in synch but the one that didn’t break yet has a good probability of breaking soon IF the others are moving with conviction. The tails will tell us how much real momentum there is RIGHT NOW. Nobody wants to keep buying if the market it’s not going up.

Looking at the charts to give us some context, we saw a nice push higher with strong momentum earlier, we have now been chopping around for the last minute or so, we have been watching them move around the centerline, looking for a move to initiate, and we are now starting to see a new push higher with momentum, as we will see by the size of the tails. So, this shows us the power market correlations can have on our trading.

We can stick with a trade when momentum is on our side – but don’t get put off by the odd pullback with weak momentum.

We can take a late break in one market when momentum is clearly coming in on the other related markets.

We can get out of a trade if momentum turns against us.

It’s fairly simple – and the tails give you an easy visual way to gauge the move.

Liquidity

Let’s now look at 2 depth and sales but with non-correlated markets, let’s look at NQ but now we are comparing it with ZN or the 10 Year Treasury Note.

The first thing that jumps to our eyes is how volatile NQ is and how slow ZN is.

ZN is considered a thicker/slower market while NQ is considered a thinner/faster market. If we look at the NQ we see an average of 5 lots on each side of the market, whereas ZN is showing an average of 2200 lots on each side.

So, while on NQ the tails can give us a sense of momentum, in ZN we can have little sense of momentum, making it more difficult to understand when traders are coming in, making the tails less useful in very slow markets.

This is why Jigsaw has so many of these little key features, so there’s something for everyone and every market.

Momentum without volume

Something we need also to pay attention to when we have momentum is the volume that comes with it. Here we are looking at the ES, we’ve been seeing an average of 25 lots on each side of the market. Let’s now forward a couple of minutes and see what is happening.

We can now see that 3 minutes later we only have on average 10 lots per side and it continues to decrease. Something changed in the market and when we see this and we have no clue what is happening, the first thing we need to do is find out what is going on. Usually, it relates to breaking news or economic data release, and for this, we use our real-time news and economic releases widgets. In this case, PPI and the Core PPI data are about to be released. So, after knowing what is happening or about to happen, we can opt to step away, wait for the news to be out, and then based on how traders react to the news, we step back in, or if we like to trade the news, we will be ready for when they get released and immediately act on it.

So, when the news starts to get released, we get this big pop higher, notice liquidity is still low which facilitates this move, but we start to see traders coming back in. The traded volume starts to increase. After the news got fully digested, we start to see the liquidity come back to normal size before the news release. The traded volume is now indicating proper buy/sell interest at these prices.

Momentum with volume

As we saw in the previous example, where traded volume was coming back in after the news release, here we have what we might call normal day-to-day trading. No news release at this time, just proper buy/sell interest.

Many traders see a fast move as being a strong move, but we disagree. Fast moves, especially low-volume ones, often are blow-offs that do not last.

Here we have the market moving up, with a lot of volume at each price and small pullbacks as we can see by the tails we are leaving behind, and these are the moves that can go on for an extended period while we keep watching and scratching our heads wondering why we didn’t get in.

Summary

IF you missed the first momentum tails video, click the link on the screen.

Let’s now do a quick summary of what we discussed in the last 2 momentum tails videos:

- When looking only at the depth and sales, the tails act as a visual representation of price movement right now

- We should not step in front of a market that shows extreme momentum with a big tail since the probability of getting run over is high

- When following correlated markets, the centerline is key to help us read the direction of each market

- The tails are useful in every market but when looking at slower markets the tails are less useful

- And finally, we looked at momentum with low volume that can generate fast moves, but often they are blow-offs whereas with high volume at each price the move can be extended for a bigger period.

So, I hope this video gave you more information on how to use the tails and if you have liked it, leave a thumbs up, subscribe to our channel, and will see you on the next video.

Thank you

[ad_2]