[ad_1]

Join Our Telegram channel to stay up to date on breaking news coverage

As the all-time highs from the previous two-year bull market fade and a new bear market appears to be settling in, only talented individuals with strong convictions will be able to find the motivation to devote themselves full-time to Web3, blockchain, and crypto.

Many curious professionals with an interest in disruptive technology have flirted with the idea of working for startups in the space during the good years of a rising crypto market. Because there are a limited number of people with the experience required to navigate this fast-paced industry and willing to embark on a new project, the demand for talent usually outpaces the supply.

Bull markets attract talent and educate newcomers about what can be accomplished with this disruptive technology. Bear markets put even the most steadfast minds to the test, rewarding those who are patient enough to wait. As the industry expands over time, more talent will be required to fuel innovation.

“I wouldn’t be surprised if bear market vibes continue in 2023,” Raman Shalupau, founder of CryptoJobsList, a platform for Web3, blockchain, and cryptocurrency job listings, said. If there are no further major collapses or regulatory surprises, we may be approaching a productivity plateau in terms of full-time opportunities in the industry. More clear business models, as well as a lot of investor money, are fueling a lot of land grab opportunities, all of which require human capital.”

While the crypto market continues to cool from all-time highs and projects tighten their budgets until the next bull cycle, finding a full-time job during a bear market does not appear as appealing and may be more difficult than during a bull market.

The current state of the crypto job market

The amount of hiring in the market can be used to gauge market sentiment.

According to CryptoJobsList data, the number of job listings and talent interested in the space has decreased by 30% to 40% when compared to the hiring frenzy at the peak of the previous bull market in February 2022.

“Hiring and talent demand have been leveling off in recent months.” Following hiring freezes and layoffs in May and June, we are seeing more companies deploying capital to hire for key positions,” Shalupau said. “As a result of some of the layoffs, we now have more talent with industry experience.”

Negative price activity has impacted demand. The abundance of talent currently looking for work can be beneficial in an innovative field like Web3. Because of the excess supply, new projects can hire qualified talent that would otherwise end up at a larger organization.

With new projects still figuring out their business models and inexperienced talent learning industry standards and best practices, it is reasonable to expect price activity and volatility to be reflected in the number of job listings.

“Typically, there is a period of uncertainty and caution that most companies exercise right after a 10% or more sell-off,” Shalupau explained. Of course, this is dependent on the nature of the business and how the treasury is managed, as many projects have allocated funds asymmetrically between fiat and stablecoins, volatile assets like Ether (and Bitcoin or risky yield farms in decentralized finance) (DeFi).

The uncertainty that comes with price volatility affects professionals’ willingness to invest their time and effort into a project. Having such a dynamic at work raises concerns among many professionals who believe that the downturn is a bad time to enter the industry. This is likely to have the greatest impact on professionals on the verge of making the full-time switch to cryptocurrency.

“Those who are still unsure whether they can make it in crypto full time get their doubts reaffirmed with the price drop and fear that follows,” Shalupau said. It may seem counterintuitive, but the reality is quite the opposite: a bear market is the best time to start working in crypto and looking for work.”

The previous cycle’s lessons

Projects tend to chase specific technical talent to add to their team at the top of each bull market, and high-level management positions such as chief technology officer are in high demand.

From 2016 to 2018, projects were required to hire Solidity developers just to launch an initial coin offering (ICO). The race then was to hire smart contract engineers to develop nonfungible token projects from 2021 to 2022.

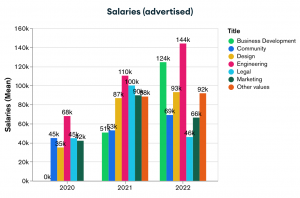

Crypto salaries advertised in the crypto industry (United States)

As the demand for crypto jobs grew, salaries began to rise in lockstep. “However, I believe the main driver is the amount of VC money in the space, which is chasing a limited talent pool,” Shalupau explained. “Projects are going for talent with a strong technical background and desire to learn crypto, rather than talent with strong prior technical experience.”

Technical jobs, such as engineering for smart contract programming languages like Solidity and Rust, have grown the most, while job responsibilities have largely remained unchanged. However, given the number of new integrations that most projects must perform these days, the amount of work may have increased.

Projects developing a cryptocurrency wallet, an interchain bridge, analytical tools, or DeFi products such as a decentralized exchange are requesting multichain support from their engineering team. When developing a product, each piece of the puzzle has its own nuances and frequently necessitates a distinct approach.

Future cycles will be repeated and improved.

The cyclical job patterns observed at the end of the 2018 bull market and into the transition period of the following years are similar to the current job landscape observed in 2022 and what is expected to occur in the coming years.

With each cycle of the space, the crypto job market gradually consolidates a stable demand for talent independent of market price action.

“Because more projects are raising in USDC, equity, and token warrants, market swings don’t impact hiring plans as much as they used to in 2016-2019 when most raises were via ICO and in ETH,” Shalupau explained, adding, “Bear market purges all the short-term opportunistic companies, and leaves space for well-funded, serious businesses to continue hiring and building.”

Established projects can continue to hire during market downturns. Proper financing enables the formation of new teams and the utilization of various skill sets that promote growth.

Related

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Maximum Supply of 2 Bn, Token Burn

- Now Listed on OKX, Bitmart, LBank, MEXC, Uniswap

- Ultra Rare NFTs on OpenSea

Join Our Telegram channel to stay up to date on breaking news coverage

[ad_2]

Source link