[ad_1]

Many traders believe they can fully assess price movement by looking only at a basic bar chart. To some extent, this is true, I’m certain that the majority of you are able to see consolidation areas, where prices are being traded inside a range, where sometimes prices test the range high to the tick, and other times prices may go above by a couple of ticks, or prices may not even touch the high at all, reversing back down, targeting the range low.

But this is how far a basic chart can go. We know that inside that range we have buyers and sellers measuring forces until one side overcomes the other, and to assess that measurement we need something else, we need the Vista chart.

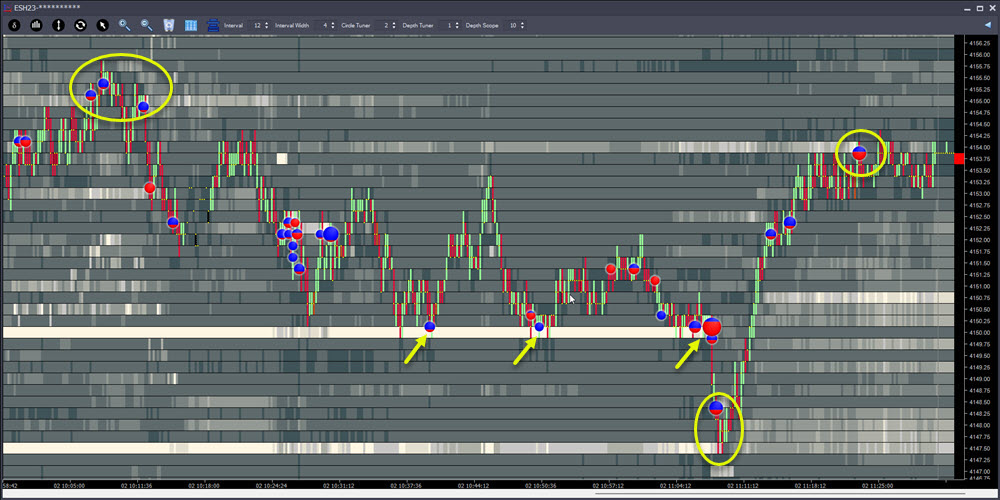

The Vista chart adds a new dimension to the price movement. The heatmap shows us the passive traders, waiting in the market, whereas the large trade circles show us the aggressive traders, hitting the bid or trying to lift the offer.

With the Vista chart, you can see how traders are behaving, how passive traders are reacting to the aggressive traders. This is of the utmost importance when looking to place a trade.

Notes:

Hi all,

Today we are going to talk about the Vista chart. It’s a self-tuning tool, where there is no need to mess around with too many options.

The Vista chart is divided into 3 main components, we have the heatmap, the price bars, and the circles. There are also some indicators and settings, but we will talk about them later on.

The heatmap and the circles allow you to understand other traders’ behavior better. For example, if you buy, you want to see other traders buying after you.

Like any other chart, on the left side, we have the trade history, and on the right side, the real-time market.

Let’s start by looking at the first component, the heatmap.

It shows a continuous view of the resting limit orders on the bid (buy) side and the offer (sell) side. The lighter the color, the more limit orders there are in the market to be executed. You can confirm this by looking at the depth sales, we have 183 lots at 35 evens and 210 lots at 33.75.

And the darker the color is, the fewer limit orders there are in the market.

The second component is the price bars, where the green bars indicate that more buy market orders were traded than sell market orders, whereas the red bars indicate that more sell market orders were traded than buy market orders.

The third and last component is the large trade circles.

These circles will be shown on the chart when there is an exceptionally large traded volume.

Their size is relative to the amount of volume traded, meaning, a large circle indicates a high traded volume, and a small circle indicates a smaller traded volume.

The circles will also show 2 colors, blue, indicating the buyers, and red, indicating the sellers.

We can see on this smaller circle, right at the low, by clicking on it, that the percentage of buyers is higher than the sellers, hence the reason it’s almost all colored blue.

The next circle has a bigger size which we already know that more volume was traded there, and also a higher percentage of buyers, again, at the low.

If we look at what the market has done so far, we had a strong selloff, where we have 2 small circles. By the color, we can see the majority of trades were on the buy side, and looking at the heatmap at the time, we can say there was a large bid, due to the light color, at those prices. If there was real buying interest, we wouldn’t have dropped like a rock afterward. Whatever buy business there was to be done, it was done, with no impact whatsoever in the downward momentum.

In the last 10 minutes or so, we’ve been in a trading range, where we can see a lot of volume has been traded near and at the low.

These 2 bigger circles show a higher percentage of sellers, which seems to indicate, by looking at the heatmap at the time, showing darker colors, that the buying interest down there was small, although some did show up seconds before the market hit the low by the lighter color we see here. Prices reverse upwards very quickly, leaving behind those sellers, giving us that sense that they just got trapped and were now being stopped out. We do see this small circle, almost all colored blue.

There was no buying interest above 32.75, right above that circle since the market came back down, retesting the previous low 2 times, and as we’ve seen earlier, those 2 retests brought buyers into the market, and since then no selling interest showed up below 29.50.

We just had a spike to the upside with 206 lots traded at 33.25 offer, I was seeing sellers hitting 32.50 and 32.25 and not much buy volume trying to lift the offer above, which made me think, if those buyers get trapped up there, we might see this reverse back down, with stops being triggered.

I place my sell order, and I do not want to see volume lifting the offer to 33.50, since that would invalidate my reading.

The order gets executed, and the market starts to push lower, although not showing the expected momentum coming from stops being triggered.

The first target gets executed and only then do we see momentum coming in, with high volume being traded. The stop loss is now moved to breakeven.

The market pushed higher, 1 tick below the stop loss, and reversed back down, executing the second target. The stop loss is now moved to plus 4 ticks at 31.75, where no buyers tried to lift the offer, and where it ends up being executed.

The Vista chart, with its heatmap and circles, gives traders a real sense of what other traders are doing or have done recently. It allows us to see their behavior, and this is of the utmost importance when looking to place a trade.

[ad_2]

Source link